Één krachtige oplossing voor het beheren en laten groeien van je vastgoedportefeuille.

Vastgoedeigenaren

"Kies Loydd Software als uw partner voor vastgoedbeheer en blijf met onze geavanceerde software altijd volledig op de hoogte van uw investeringen,

Vastgoedbeheerders

"Onze intelligente software maakt vastgoedbeheer niet alleen leuker maar ook eenvoudiger, resulterend in tijds- en kostenbesparingen.

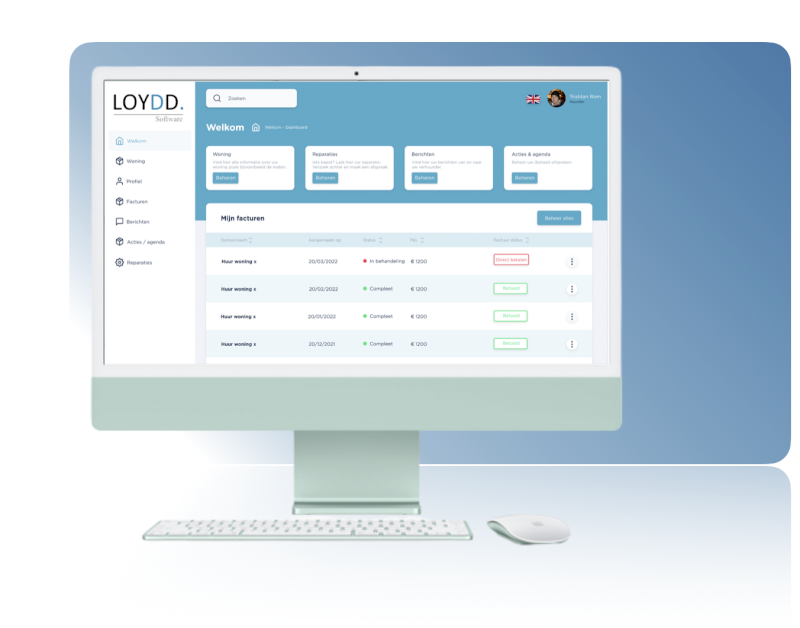

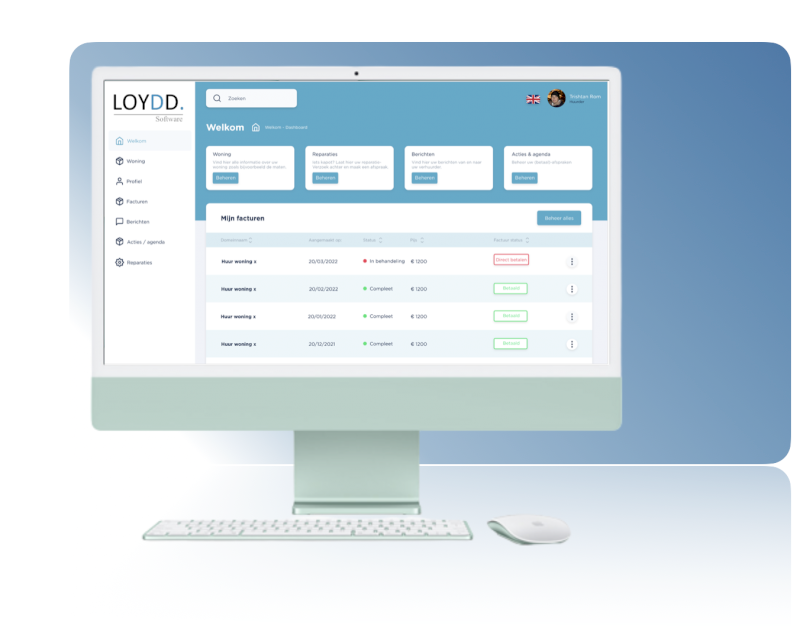

Huurdersportaal

"Ons huurdersportaal maakt het huurders gemakkelijk om alles te regelen en te raadplegen.

Debiteurenbeheer

Loydd Software maakt debiteurenbeheer moeiteloos, voor een efficiënter en persoonlijker beheer van uw organisatie.

Ontdek de voordelen

Volledige Vastgoedbeheer Suite

Beheer al je vastgoedactiva met Loydd: huuradministratie, onderhoudsplanning, rapportage en documentbeheer, alles op één plek.

Flexibiliteit en Schaalbaarheid

Loydd Software groeit met je mee, van enkele eenheden tot uitgebreide vastgoedportefeuilles, dankzij onze schaalbare oplossingen.

Slimme Automatisering

Bespaar tijd, minimaliseer fouten: laat Loydd repetitieve taken automatiseren, zodat jij je kunt richten op strategische beslissingen en groei.

Real-time Inzichten

Neem weloverwogen beslissingen met real-time gegevens. Onze software houdt je portefeuille, prestaties en trends up-to-date, zodat je altijd voorop loopt.

Geautomatiseerd waar het kan, persoonlijk waar het moet

Volledige controle over uw financieel, commercieel en technische beheer

Projectbeheer

Volg renovatie- en bouwprojecten met ingebouwde planningstools.

Multi-Tenant Support

Beheer meerdere panden en huurders in één overzichtelijk dashboard.

Nieuwe Huurder Verificatie

Automatische screening van potentiële huurders op kredietwaardigheid en geschiktheid.

Onderhoudsbeheer

Plan preventief onderhoud en houd onderhoudsgeschiedenis bij.

Documentbeheer

Verzamel, organiseer en bewaar huurdersdocumenten en contracten veilig.

Rapportage en analyse

Realtime data en uitgebreide rapportageopties voor beter inzicht in vastgoedprestaties.

Communicatieplatform

Naadloze communicatie met huurders, eigenaren en leveranciers via ingebouwde tools.

Incassobureau

Eigen geïntegreerd incassosysteem voor snelle en effectieve schuldinvordering.

Integraties met Derden

Koppel eenvoudig met boekhoudsoftware, CRM-systemen en meer.

Klantenportaal

Huurders en eigenaren kunnen eenvoudig toegang krijgen tot hun gegevens en betalingen.

SaaS en Cloudopslag

Werk overal en altijd via een veilige en schaalbare cloudomgeving.

Internationale Ondersteuning

Volledig ingericht voor gebruik in meerdere talen en valuta.

Het laatste nieuws

Lees hier het laatste nieuws en schrijf u in voor de nieuwsbrief

Overstappen van Excel naar vastgoedbeheer software

Werkt u als vastgoedbeheerder of particuliere belegger nog met EXCEL bestanden? Dat werkt prima, maar soms heeft u het gevoel dat het overzichtelijker en makkelijker kan. Vooral als uw portefeuille groeit, of als u informatie van meerdere jaren moet verwerken.

Vastgoedbeheer digitaliseren

Als particuliere belegger of vastgoedbeheerder bent u een groot deel van uw tijd kwijt aan contactmomenten. U hebt minder overzicht over de huurbetalingen dan u zou willen en een groot deel van de gegevens staan in grote en onoverzichtelijke EXCEL bestanden. Het werkt allemaal prima, maar u heeft het gevoel dat het efficiënter en gemakkelijker kan.

Huren incasseren met iDEAL, incasso, QR of handmatig

Hoe wordt bij u de huur geïnd? Er zijn verschillende manieren om huren te innen als particuliere verhuurder of beheerderskantoor. Wat werkt het beste voor verhuurders èn huurders? Wat zijn de verschillende mogelijkheden? Hier alle voor- en nadelen op een rij.

Neem contact met ons op

Bent u geïnteresseerd in onze software? Vul het onderstaande contactformulier in en wij nemen binnen 2 uur contact met u op!

CONTACT

| Loydd Software Jufferstraat 396 3011 XM Rotterdam |

|

| Telefoon | +31854017790 |

| Email: | info@loyddsoftware.com |

OPENINGSTIJDEN

| Ma t/m Vr | 08:30 – 17:00 |

| Zaterdag | Gesloten |

| Zondag | Gesloten |